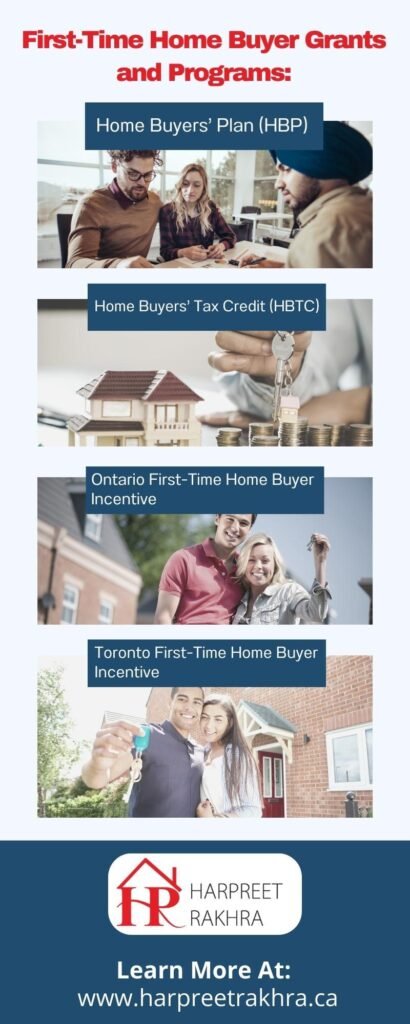

First-Time Home Buyer Grants and Programs: Unlocking the Door to Ownership

Are you a first-time home buyer? Are you curious to know the government grants and programs you can apply? You are lucky that you are in Canada and can apply for plenty of government grants and programs that would save you thousands of dollars on your first home purchase.

Since real estate investment is an expensive and one-time investment, you should definitely take advantage of the grants the Canadian government is providing to make your pathway to homeownership an easy one. In this blog, we’ll take you through the grants and schemes available for first-time home buyers in Brampton.

Incentives for first-time home buyers:

1. Home Buyers’ Plan (HBP)

Also known as HBP, the Home Buyers’ Plan is a federal government incentive for first-time house buyers. Under this plan, eligible home buyers can use funds from their Registered Retirement Savings Plans (RRSPs) to purchase or build a qualifying home. For now, the maximum withdrawal amount for an eligible home buyer’s RRSP is $35,000.

Using this money, a home buyer can buy a home tax-free and is required to repay the withdrawn RRSP fund within 15 years. The eligibility to withdraw includes:

- You must be a Canadian resident

- The fund withdrawn from RRSP should have been there in your account for no less than 90 days.

- You must not have purchased and cannot even purchase a home four years prior to withdrawal.

- If you’re buying with a spouse or common-law partner who isn’t a first-time buyer, make sure you haven’t lived in their home for more than four years.

- You must have entered into a formal agreement to buy a home before funds are withdrawn.

- You must intend to live in the home you are purchasing for at least one year

For more details on the HBP plan, contact a real estate broker in Brampton.

2. Home Buyers’ Tax Credit (HBTC)

Home Buyers’ Tax Credit is another first-time home buyer’s grant announced by the Federal Government of Canada. Similar to a tax rebate, it allows qualified home buyers to receive an income tax credit of up to $5,000 on a qualifying home with a maximum of up to $750 tax credit available.

To apply for the Home Buyers’ Tax Credit in advance, simply put it on Line 31270 of your corresponding year’s income tax form and wait for the Canada Revenue Agency to provide a rebate once your return has been submitted successfully. The eligibility criteria include:

- The home you purchased is a qualifying home registered in your or your spouse’s or common-law partner’s name.

- You are a first-time home buyer and have never lived in a home that you or your spouse or common-law partner own.

- The home you purchased currently is or will be your primary residence within one year of purchase.

For more details on the Home Buyer’s Tax Credit, contact Harpreet Rakhra in Brampton.

3. Ontario First-Time Home Buyer Incentive

If you are living in Ontario, you may be eligible to receive benefits from this first-time home buyer scheme. When purchasing the first home, home buyers are eligible for a land transfer tax rebate of up to $4,000. This means that if you buy a home in Ontario for $368,000 or less, you will not have to pay any land transfer tax. In case, the property costs more than $368,000, you’ll receive a reduction of up to $4,000 on your land transfer tax.

The eligibility criteria for the Ontario First-Time Home Buyer Incentive include:

- You are a first-time home buyer and never purchased a home in Canada or another nation.

- Your spouse or common-law partner is a first-time home buyer who has never owned a house before.

- You are an 18-year-old Canadian citizen or a permanent resident.

For more details on Ontario First-Time Home Buyer Incentive, contact a realtor in Brampton.

4. Toronto First-Time Home Buyer Incentive

The Toronto First-Time Home Buyer Incentive is for those planning to buy their first home in Toronto. This incentive is provided by the municipality and is a land transfer tax rebate. First-time home buyers who qualify can receive a rebate of up to $4,475 on their municipal land transfer tax

The eligibility requirement for this incentive is the same as that of the Ontario First-Time Home Buyer Incentive program.

• You are a first-time home buyer and never purchased a home in Canada or another nation.

• Your spouse or common-law partner is a first-time home buyer who has never owned a house before.

• You are an 18-year-old Canadian citizen or a permanent resident.

For more details on Toronto First-Time Home Buyer Incentive, feel free to consult a real estate agent in Brampton.

Home buying is an exciting decision and should be taken only after assessing your financial condition and the grants and incentives you are eligible to apply for. If you are searching for your dream first home, let Harpreet Rakhra help you out with the latest property listings in Brampton and its surroundings.